Trade shows and the pandemic effect

The effect of the pandemic on the events industry has been well-charted; you would be forgiven for thinking you knew the whole story.

Explori has access to event feedback data collected from attendees and exhibitors at 4,000 trade shows in 50 countries, a dataset that is representative of 200 million trade show experiences. This data tells the story of thousands of individual events, but at an aggregate level it also provides an unparalleled view of just how the pandemic has shaped the industry – for better and for worse.

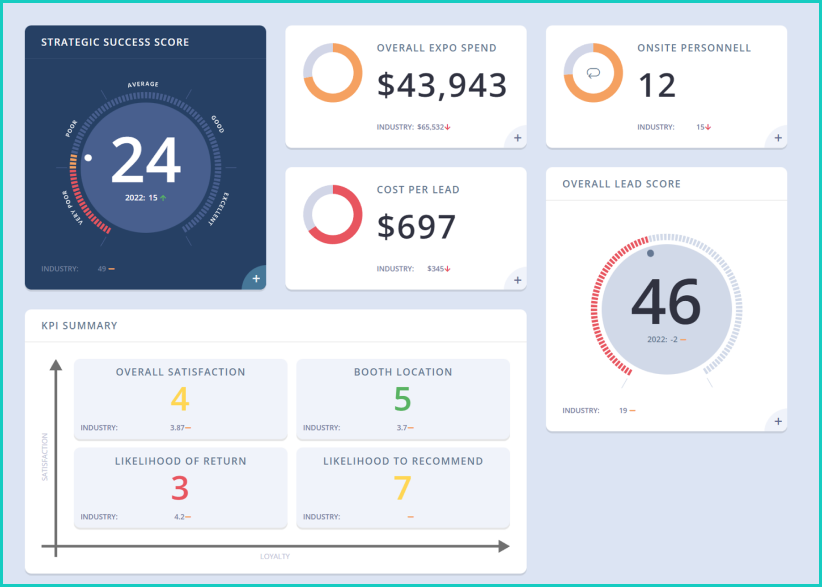

All of Explori’s post-event surveys collect attendee and exhibitor data to create key benchmarking metrics. These benchmarks allow event teams to compare individual events against industry standards, and to track the progress of their own events over time. So what can these metrics reveal about how the industry has changed – and how should this knowledge inform event strategy?

Post-pandemic, NPS is on the up

One of Explori’s key benchmarks is the event’s Net Promoter Score, or NPS score, which measures how likely a participant in a particular trade show is to recommend the event to a friend or colleague.

In previous years, the average NPS score for trade shows remained relatively static, moving by a few points at most year-on-year. From 2021, however, when events began to take place in person once again, the NPS average shot up by almost 20 points.

Good news? It’s not quite so simple…

The complicated role of event importance

When a previously stable datapoint changes dramatically, it’s a clear sign that something is happening behind the scenes.

After years of pandemic-induced disruption, professionals in every industry looked forward to the return of business-as-usual trade shows. Some events began to return, tentatively, to in-person formats. The importance of these events – another of Explori’s benchmarks – was increased by the scarcity of the last few years, with each event representing a rare opportunity to connect with colleagues in-person.

We all want our events to be thought of as important – right?

Well – yes. But the importance isn’t always a dependable metric. A show might be rated as important by attendees one year because its only competitor was cancelled, or because – hypothetically – it’s the first time the show is going ahead after, say, an unprecedented global pandemic shut down in-person events for two years. That benefits the show in that particular year – but what about the year after, or the year after that?

Analysis by Explori found evidence of an ‘importance bump’, meaning that enhanced importance scores can inflate the NPS of events with lower satisfaction scores, another Explori benchmark. Events with high importance scores and low satisfaction scores tend to pull in ‘hostage’ attendees, who are there in the absence of a better option – leaving the event vulnerable to disruption.

The reality is that NPS scores should not be considered in isolation – we need to be looking at what’s going on under the hood. Higher NPS scores may be indicative of a post-pandemic bubble, rather than telling us that events are back and better than ever. In fact, a closer look at the data tells us that attendee and exhibitor needs have changed significantly in this new era.

Redefining success: Quality over quantity

What do you imagine when you picture a successful trade show? Walkways thronged with people; a rising swell of conversation; meetings at stands, in lounges, over lunches.

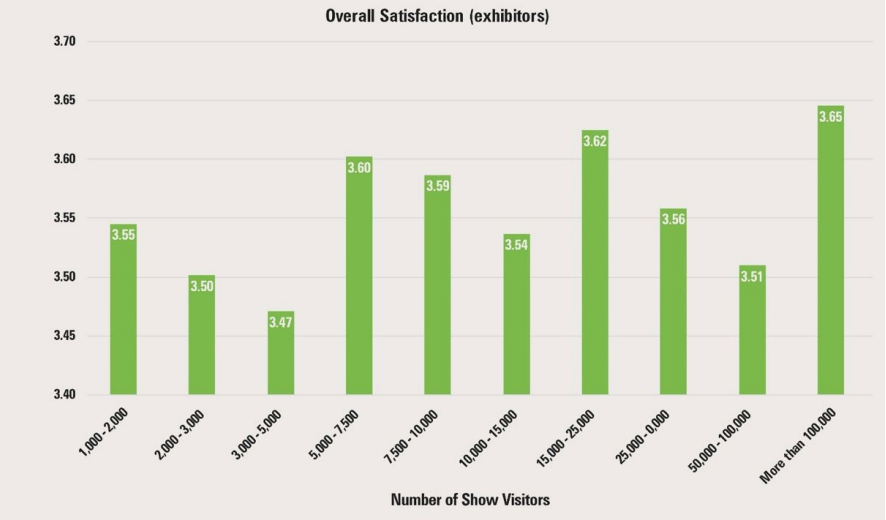

Understandably, many of us equate high attendance with success. And yet Explori’s data suggests that there is no correlation between the number of visitors and exhibitor satisfaction scores.

Four in five exhibitors say that visitor quality has a strong influence on their decision to exhibit at a given show, compared to three in five who say the same for visitor quantity.

Creating a positive exhibitor experience is clearly integral to the success of a show, and Explori’s analysis has found that higher exhibitor NPS scores lead to higher spend. So what else are exhibitors looking for?

Post-pandemic, exhibitors are more likely to give an event a high NPS score if they feel they were able to meet with existing customers and launch new products into the market. Conversely, generating new sales leads and taking orders were less likely to correlate with high NPS scores, indicating that sales-based objectives have taken a backseat.

Attendees, too, are keen to meet disruptive exhibitors bringing new products into the market. Post-pandemic, successfully discovering innovative products and solutions is the biggest driver of attendee satisfaction.

What does this mean for event organizers?

- Exhibitor satisfaction is crucial. Trade show organizers should work closely with their exhibitors to understand their objectives and take the time to train them so they can work at their best.

- Organizers should shift their focus, prioritising quality of attendees and exhibitors over quantity. Armed with the data, event organizers should feel bold enough to attract fewer, higher-quality visitors.

- The exhibitor mix is also incredibly important. Attendees report higher satisfaction when they attend trade shows that introduce them to new, market-disrupting suppliers and products. The most nimble, disruptive exhibitors tend to be smaller, newer organizations, with smaller marketing budgets. Alternative pricing models that moved away from a strict price-per-square-metre format could make it much more attractive for these organizations to exhibit.

.png?width=150&height=61&name=explori_logo%20(1).png)