The Global Recovery Insights 2021 report published: the road to recovery

Oct 28, 2021

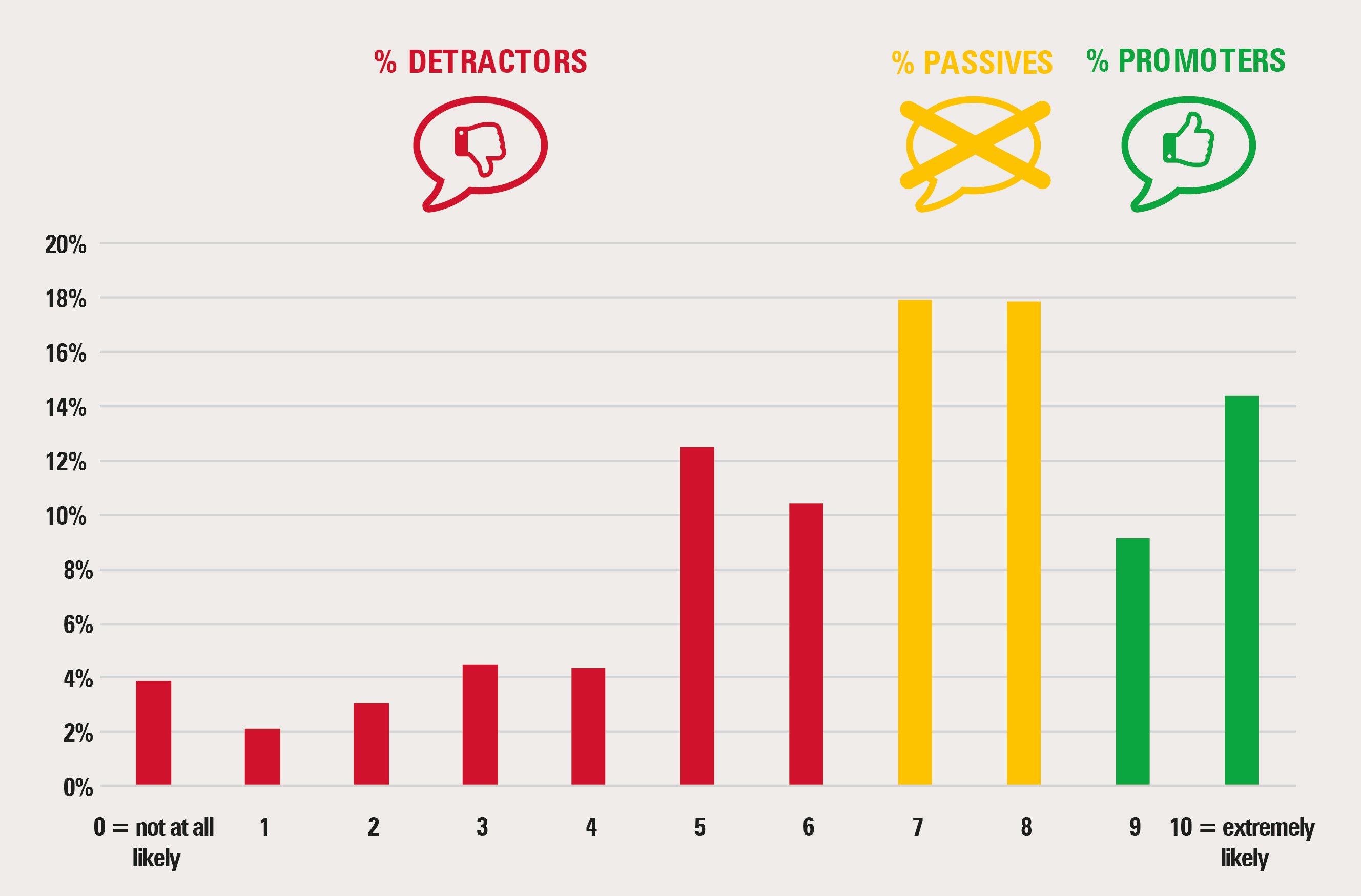

Second part of the Global Recovery Insights 2021 report is now available. - Latest data reflects optimism in the industry as demand has recovered for live events from both exhibitors and visitors - Impact on spend has been less severe than feared - Visitor quality favoured over quantity Paris / London – 21 October 2021: UFI and Explori are today releasing the second part of the Global Recovery Insights 2021 report, conducted by live events research specialists, Explori in partnership with UFI, the Global Association of the Exhibition Industry and supported by SISO, the Society for Independent Show Organizers. This latest recurring quantitative global survey of trade show visitors and exhibitors, carried out in the summer of 2021, collectively gained 15,000 responses in 10 languages, representing trade show participation in over 30 countries. The report focused on five key themes which build on, and can be compared with, the findings of previous Global Insights studies. The study found that demand has returned to pre-pandemic levels for both exhibitors and visitors, with no signs of a fundamental shift away from in-person trade shows as a channel. 72% of existing visitors say they plan to attend trade shows with the same or increased frequency in future, with 62% of exhibitors reporting the same intention. The impact of the pandemic on spend has been far less severe than feared and 75% of exhibitors expect budgets to return to normal within 12 months. In previous studies, exhibitors favoured shows with high visitor numbers, but this appears to have shifted with 86% of exhibitors stating visitor quality is a larger influence on their decision to invest in a show against 67% citing visitor numbers. Where exhibitors are looking to make savings, high quality shows appear protected, and exhibitors who now consider the cost of exhibiting to be a large influence on their decision to support a specific show has grown to 29% since 2020. Live and face-to-face remains the preferred channel for networking and overall experience. Exhibitors are not diverting significant percentages of the budget to digital, although it is seen as a way to test new events and has the potential to deliver content and widen audiences. Many exhibitors are wary of future participation in digital and hybrid models, with low Net Promoter Scores (NPSSM) compounded by even lower scores for digital events, suggesting digital is a significant challenge for those who wish to pursue a revenue stream from this model. However, despite these findings, a new group was surveyed for the first time in this research who were strikingly more likely to convert from digital participation to in-person participation than either current visitors or exhibitors. Made up senior marketing decision makers based in the US or UK who had not used trade shows as a marketing channel prior to the pandemic, ‘the panel’ expect digital to remain part of their marketing mix, indicating that there is potential to convert them to exhibitors at live events and that the digital events that arose during the pandemic have attracted new audiences. “The report gives plenty of reasons for optimism, including quelling doubts about a possible shift away from live events and indicating which shows are likely to bounce back quickly. At a time where physical trade shows are restarting around the world, we hope that these findings will help the industry to a fast recovery and beyond.” said Kai Hattendorf, UFI CEO. Sophie Holt, Managing Director, Explori added: “Whilst the need for some exhibitors to make savings remains, the Global Recovery Insights reflects the optimism felt by the exhibition industry, that live events will soon return to pre-pandemic levels. Budget cuts have not been as harsh as predicted in 2020 and spend is expected to return to 2019 levels within an average show cycle. Quality shows are likely to be protected and digital has opened up new opportunities to widen audiences convert naysayers to the power of live!” The full report is now available to download free here.

.png?width=150&height=61&name=explori_logo%20(1).png)

.png)

.png)